What We Do

Farmers feed the world & we help them do it.

We work with nutritionists to formulate customized diets that will maximize your herd’s productivity and health. All at reasonable prices so you can increase your profitability and keep doing the hero work of feeding our world.

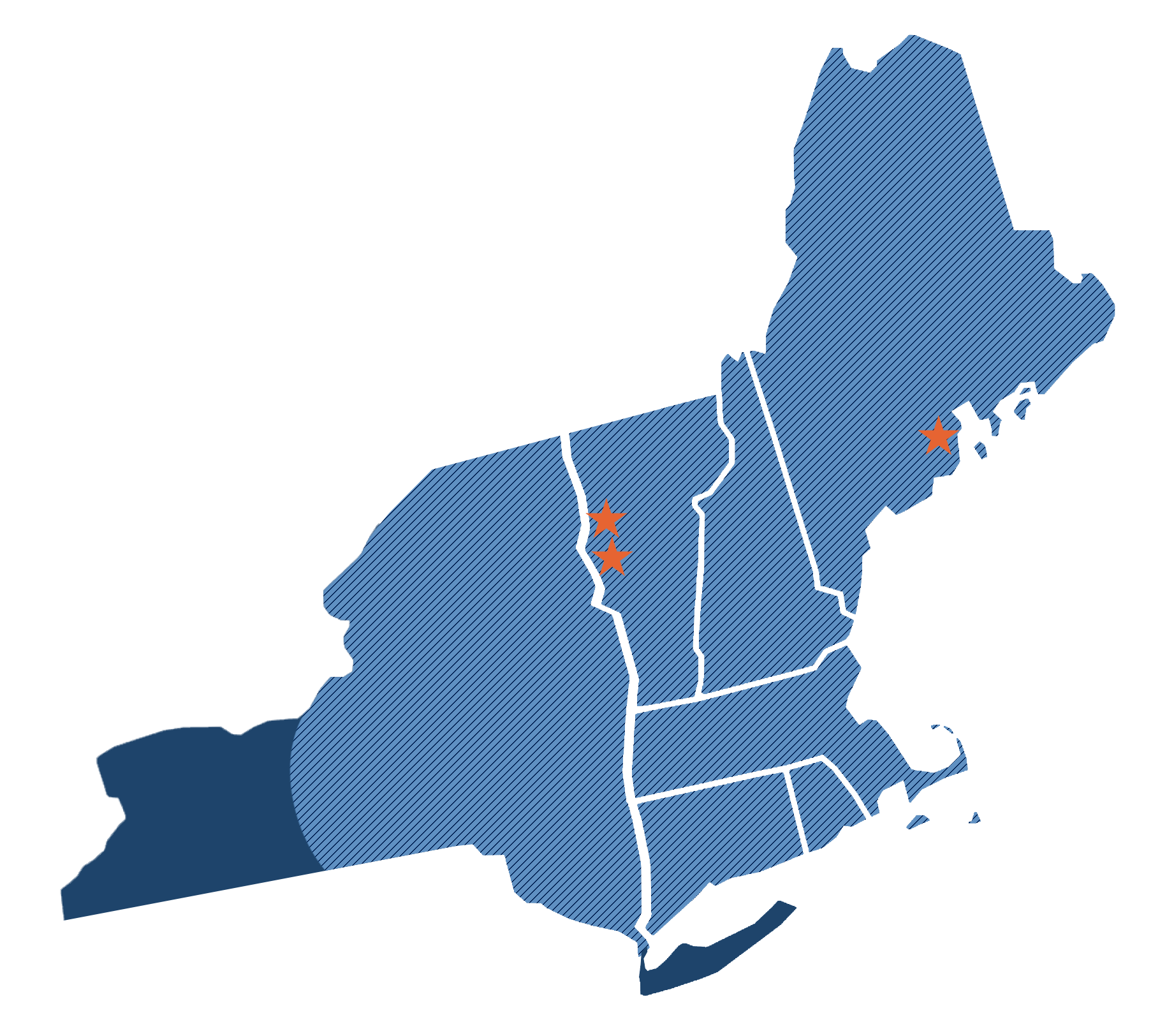

areas we cover

Unbeatable service across

New England and New York.

Our agile, regional business model allows us to be efficient, so you get on-time, cost-effective deliveries that fit into your production model.

Why Phoenix Feeds & Nutrition

The partner farmers and nutritionists trust to get ahead.

Our staff of 80+ work with the same maverick-like mindset that farmers do. We regularly test our ingredients against our competition to ensure we deliver higher-than-average protein standards, digestibility, and more, at the best possible price.

That’s why:

20+ independent nutritionists trust Phoenix Feeds & Nutrition

We have a stake in your success

27% of our company is owned by our employees, all with a stake in your success

We have a stake in your success

27% of our company is owned by our employees, all with a stake in your success

We have a stake in your success

27% of our company is owned by our employees, all with a stake in your success

What Our Customers Are Saying

“With how our operation runs and the day-to-day, we are just a more efficient machine than we were prior to working with David and Phoenix.”

-Chase Goodrich, Goodrich Family Farm, Salisbury, Vermont

“I never thought I’d make it to a herd average of 20,000 pounds, but [Phoenix] has taken us there.”

-John Hornstra, Hornstra Farms, Norwell, Massachusetts

– Miles Hooper, Ayers Brook Goat Dairy, Brookfield, Vermont

News

News and resources to help you grow your business.

Goodrich Family Farm Sees Better Herd Health and Profits with Nutritional Expertise

In today's world, where global networks dictate prices paid to farmers, staying in business and being profitable isn't easy. That’s why it takes strategic investments to be successful. “We felt like we could really expand our production and have...

Monument Farms Dairy Set to Grow Their Beloved Vermont Milk Brand

The farmer-owners at Monument Farms Dairy in Weybridge, Vermont, are preparing to tackle one of their biggest challenges – and it’s a problem most business owners wouldn’t mind having. “We’re always faced with having more people wanting our product than we’re able...